Bloom(1)Bloomberg(8)Futures(91)Stock(6936)

In the fast-paced world of finance, staying ahead of market trends is crucial. For investors and traders, Bloomberg is a go-to source for real-time data and analysis. One of the most watched segments on Bloomberg is the US stock futures market. This article delves into what US stock futures are, how they are traded on Bloomberg, and the impact they have on the overall market.

Understanding US Stock Futures

US stock futures are financial contracts that allow investors to buy or sell shares of a particular stock at a predetermined price on a specified future date. These contracts are a great way for investors to hedge their positions or speculate on the direction of the market. The most popular US stock futures are based on indices like the S&P 500, NASDAQ 100, and the Dow Jones Industrial Average.

Trading US Stock Futures on Bloomberg

Bloomberg provides a comprehensive platform for trading US stock futures. Traders can access real-time quotes, charts, and news that help them make informed decisions. Here’s how you can trade US stock futures on Bloomberg:

- Open a Bloomberg Terminal: To access the full range of features, you need a Bloomberg Terminal. This powerful tool offers a wide array of financial data and analysis.

- Navigate to the Futures Section: Once you have access to the Bloomberg Terminal, navigate to the futures section. Here, you will find a list of available US stock futures.

- Choose Your Futures Contract: Select the futures contract that matches your investment strategy. For example, if you want to trade the S&P 500, choose the corresponding futures contract.

- Place Your Order: After selecting your futures contract, you can place your order. You can choose to go long (buy) or short (sell) based on your market outlook.

- Monitor Your Position: Once you have placed your order, monitor your position in real-time. Bloomberg provides a range of tools to help you track your investments.

The Impact of US Stock Futures on the Market

US stock futures play a significant role in the overall market. Here’s how they impact the market:

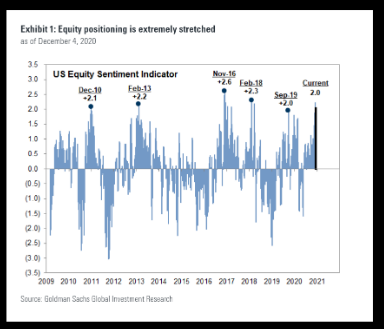

- Market Sentiment: The movement of US stock futures can provide insights into market sentiment. For example, if futures are rising, it may indicate optimism in the market.

- Volatility: US stock futures can influence market volatility. A sharp move in futures can lead to increased volatility in the underlying stocks.

- Predictions: Traders often use US stock futures to predict market movements. By analyzing futures data, they can make informed decisions about their investments.

Case Study: The Impact of US Stock Futures on the S&P 500

In February 2020, the S&P 500 futures experienced a sharp decline due to concerns about the COVID-19 pandemic. This decline in futures led to increased volatility in the stock market, as investors reacted to the potential impact of the pandemic on the economy. The case study highlights the significant role that US stock futures can play in influencing market movements.

Conclusion

US stock futures are a vital tool for investors and traders looking to stay ahead of market trends. With Bloomberg’s comprehensive platform, accessing and trading US stock futures has never been easier. By understanding how US stock futures work and their impact on the market, investors can make informed decisions and navigate the complexities of the financial world.

us stock market today live cha