REIT(5)The(3855)Stock(6936)R(21)

In recent years, the real estate investment sector has seen a significant surge in popularity, and one of the most sought-after investment avenues is through REIT stocks in the United States. Real Estate Investment Trusts (REITs) have emerged as a favorite among investors due to their unique characteristics and potential for high returns. This article delves into the world of REIT stocks in the US, explaining their benefits, risks, and how to invest in them effectively.

What is a REIT Stock?

A REIT stock represents shares of a Real Estate Investment Trust, which is a company that owns or finances income-generating real estate across various property sectors, including residential, commercial, industrial, and hospitality. REITs are required by law to distribute at least 90% of their taxable income to shareholders, making them an attractive investment option for income seekers.

Benefits of Investing in REIT Stocks

- High Dividends: REIT stocks are known for their high dividend yields, often higher than those of traditional stocks. This makes them an ideal investment for income-oriented investors.

- Diversification: By investing in REIT stocks, investors can gain exposure to a wide range of real estate assets without having to own physical property. This diversification helps reduce risk and enhance portfolio performance.

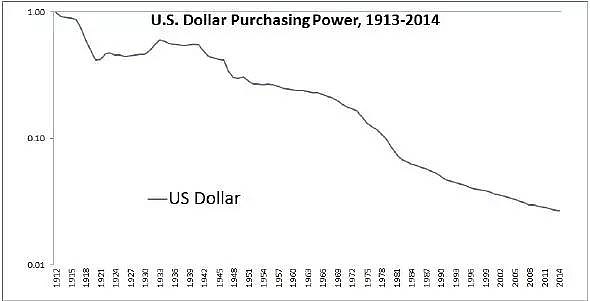

- Inflation-Protected Returns: Real estate tends to appreciate over time, and REIT stocks can provide inflation-protected returns as property values increase.

- Ease of Access: REIT stocks are easily accessible through major stock exchanges, making it convenient for investors to buy and sell shares.

Risks of Investing in REIT Stocks

- Interest Rate Sensitivity: REIT stocks are sensitive to changes in interest rates. As interest rates rise, the cost of financing real estate properties increases, which can negatively impact REIT performance.

- Economic Cycles: Real estate markets are cyclical, and REIT stocks can be affected by economic downturns, leading to lower property values and rental income.

- Liquidity Risk: While REIT stocks are generally liquid, they may not be as easily sold as traditional stocks, especially during market downturns.

How to Invest in REIT Stocks

- Research and Analysis: Before investing in REIT stocks, it is crucial to conduct thorough research and analysis. Look for REITs with strong financials, a diversified portfolio, and a history of consistent dividend payments.

- Diversify Your Portfolio: To mitigate risk, consider investing in a mix of REIT stocks across different property sectors and geographic locations.

- Use a Brokerage Account: Open a brokerage account to buy and sell REIT stocks. Many online brokers offer low fees and a wide range of investment options.

Case Study: Amazon Property Trust (APT)

One notable REIT stock in the US is Amazon Property Trust (APT), which owns a portfolio of industrial properties across the country. APT has seen significant growth in its stock price, driven by the increasing demand for industrial real estate due to the rise of e-commerce. By investing in APT, investors can gain exposure to the thriving e-commerce sector and potentially earn high dividends.

In conclusion, REIT stocks in the US offer a unique investment opportunity with the potential for high returns and income. However, it is crucial to conduct thorough research and understand the associated risks before investing. By diversifying your portfolio and staying informed about market trends, you can maximize your chances of success in the world of REIT stocks.

us stock market today live cha