Malaysia(14)Purchase(22)Stocks(4126)How(825)A(88)

Are you looking to invest in US stocks but unsure how to get started from Malaysia? Investing in foreign stocks can seem daunting, but with the right guidance, it's a manageable process. In this article, we will explore the steps and considerations for purchasing US stocks from Malaysia.

Understanding the Basics

Before diving into the process, it's essential to understand the basics of purchasing US stocks. Stocks represent ownership in a company, and when you buy a stock, you become a shareholder. The value of your investment will fluctuate based on the company's performance and market conditions.

Choosing a Brokerage Firm

The first step in purchasing US stocks from Malaysia is to choose a brokerage firm. A brokerage firm acts as an intermediary between you and the stock market, facilitating the buying and selling of stocks. Here are some factors to consider when selecting a brokerage firm:

- Regulation: Ensure the brokerage firm is regulated by a reputable authority, such as the Securities Commission Malaysia (SC) and the Financial Industry Regulatory Authority (FINRA) in the United States.

- Fees: Compare the fees charged by different brokerage firms, including commission rates, account maintenance fees, and currency conversion fees.

- Platform: Choose a brokerage platform that is user-friendly and offers the necessary tools for research and analysis.

Opening an Account

Once you have chosen a brokerage firm, you'll need to open an account. This process typically involves providing personal information, proof of identity, and financial details. Here's what you can expect:

- Verification: Be prepared to provide identification documents, such as a passport or driver's license, and proof of address.

- Financial Details: Provide your bank account information for funding your brokerage account.

- Account Funding: Deposit funds into your brokerage account to start purchasing stocks.

Understanding Currency Conversion

When purchasing US stocks from Malaysia, you'll need to consider currency conversion. The value of the US dollar (USD) and the Malaysian ringgit (MYR) will affect the amount you pay for each stock. Here are some tips for managing currency conversion:

- Compare Exchange Rates: Use a reliable currency conversion tool to compare exchange rates from different providers.

- Use a Brokerage with Competitive Exchange Rates: Some brokerage firms offer competitive exchange rates, which can save you money.

- Monitor Exchange Rates: Keep an eye on currency fluctuations to take advantage of favorable rates.

Purchasing US Stocks

Once your brokerage account is funded, you can start purchasing US stocks. Here's how to get started:

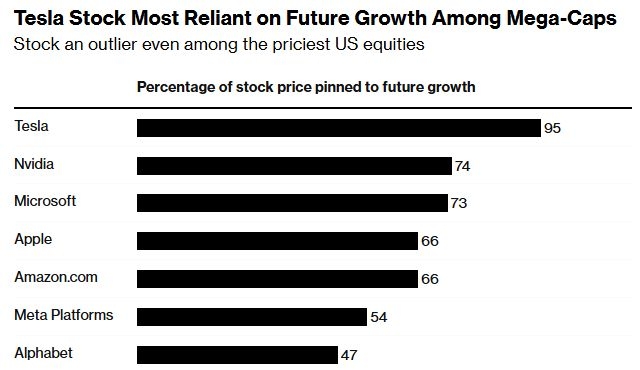

- Research: Conduct thorough research on the stocks you're interested in. Consider factors such as the company's financial health, market position, and growth prospects.

- Place an Order: Use your brokerage platform to place a buy order. You can specify the number of shares you want to purchase and the maximum price you're willing to pay.

- Monitor Your Investment: Keep an eye on your investment's performance and make adjustments as needed.

Case Study: Investing in Apple Inc.

Let's say you're interested in investing in Apple Inc. (AAPL). Here's how you can get started:

- Choose a brokerage firm that offers access to US stocks and has a competitive exchange rate.

- Open an account and fund it with the required amount.

- Conduct research on Apple Inc. to understand its financial health and growth prospects.

- Place a buy order for the desired number of shares at your specified maximum price.

By following these steps, you can successfully purchase US stocks from Malaysia. Remember to stay informed, conduct thorough research, and manage your risk to maximize your investment returns.

us stock market today live cha