Canada(51)Buying(93)from(272)Stocks(4126)Comp(184)

Are you a Canadian investor looking to diversify your portfolio with US stocks? Buying US stocks from Canada can be a smart move, offering access to a vast array of investment opportunities. However, navigating the process can be complex. This article will provide you with a comprehensive guide to buying US stocks from Canada, covering everything from the benefits to the steps involved.

Benefits of Buying US Stocks from Canada

One of the primary benefits of buying US stocks from Canada is the ability to invest in a diverse range of companies. The US stock market is one of the largest and most liquid in the world, offering exposure to industries and sectors that may not be available in Canada. This can help you diversify your portfolio and potentially increase your returns.

Another significant advantage is the potential for currency appreciation. If the Canadian dollar strengthens against the US dollar, your returns in Canadian dollars could increase. Additionally, buying US stocks can provide access to innovative companies and emerging markets that may not be available in Canada.

How to Buy US Stocks from Canada

Open a Brokerage Account: The first step is to open a brokerage account with a reputable brokerage firm that offers access to US stocks. Many Canadian brokers offer this service, including TD Ameritrade, Questrade, and BMO InvestorLine.

Research and Select Stocks: Once you have your brokerage account, research and select the stocks you want to buy. Consider factors such as the company's financial health, industry trends, and valuation.

Understand the Risks: It's important to understand the risks involved in buying US stocks from Canada. Currency exchange rates can fluctuate, and there may be additional fees and taxes to consider.

Place Your Order: Once you've selected your stocks, place your order through your brokerage account. You can choose to buy shares of individual companies or invest in exchange-traded funds (ETFs) that track a basket of US stocks.

Monitor Your Investments: After purchasing US stocks, it's important to monitor your investments regularly. Stay informed about the company's financial performance and industry trends, and be prepared to adjust your portfolio as needed.

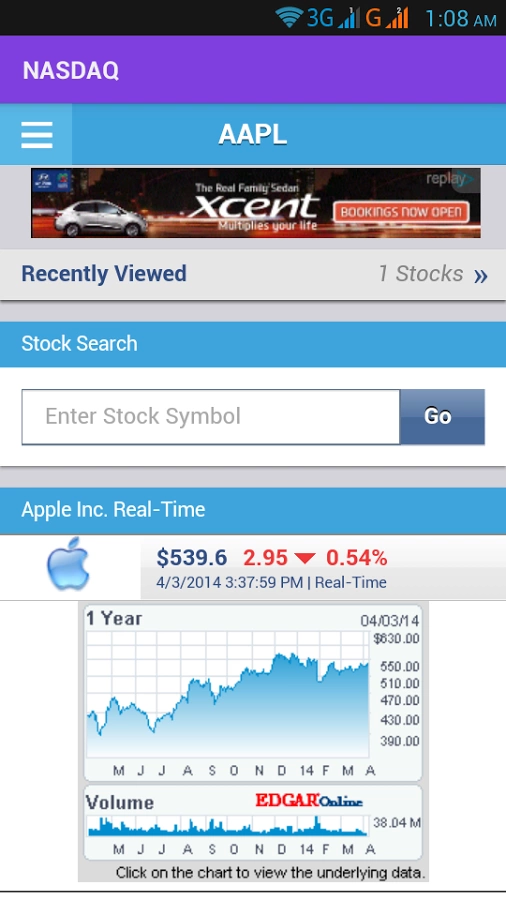

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical scenario where a Canadian investor decides to buy shares of Apple (AAPL) from their brokerage account. By doing so, they gain exposure to one of the world's most successful and innovative companies. If the US dollar strengthens against the Canadian dollar, their returns in Canadian dollars could increase.

Additional Tips

- Consider Using a Tax-Free Savings Account (TFSA): Investing in a TFSA can provide tax advantages when buying US stocks from Canada.

- Stay Informed: Keep up with financial news and market trends to make informed investment decisions.

- Seek Professional Advice: If you're unsure about buying US stocks from Canada, consider seeking advice from a financial advisor.

Buying US stocks from Canada can be a valuable strategy for diversifying your portfolio and accessing a wide range of investment opportunities. By understanding the process and following these tips, you can make informed decisions and potentially increase your returns.

us stock market today live cha