August(42)2011(4)Market(1992)Stock(6936)Compr(159)

In August 2011, the US stock market experienced a period of significant volatility and uncertainty. This article delves into the key factors that influenced the market during this time, providing a comprehensive analysis of the events and their impact on investors.

Market Overview

The month of August 2011 marked a critical juncture for the US stock market. At the beginning of the month, the market was already grappling with concerns over the European debt crisis and its potential impact on the global economy. As the month progressed, these concerns intensified, leading to widespread market turmoil.

Key Factors Influencing the Market

European Debt Crisis: The ongoing debt crisis in Europe was a major concern for investors. The uncertainty surrounding the Greek debt situation and the potential for a default led to widespread fears of a broader European financial crisis. This uncertainty spilled over into the US stock market, causing investors to sell off their holdings.

US Economic Concerns: In addition to the European debt crisis, the US economy was also facing its own set of challenges. The slow recovery from the 2008 financial crisis, coupled with rising unemployment and concerns over the federal deficit, contributed to a negative sentiment in the market.

Fiscal Policy Uncertainty: The debate over the debt ceiling and potential default by the US government added to the market's uncertainty. This debate highlighted the challenges faced by policymakers in addressing the country's fiscal issues, further weighing on investor confidence.

Corporate Earnings: Despite the overall negative sentiment, some companies reported strong earnings during the month. However, these positive reports were often overshadowed by the broader market concerns, leading to mixed reactions in the stock market.

Market Performance

The S&P 500 Index, a widely followed benchmark for the US stock market, experienced significant volatility during August 2011. The index opened the month at around 1,200 points and closed at approximately 1,140 points, representing a decline of nearly 5%. This decline was driven by a combination of the factors mentioned above, including the European debt crisis, US economic concerns, and fiscal policy uncertainty.

Case Studies

One notable case during this period was the collapse of MF Global, a commodities trading firm. The firm filed for bankruptcy on October 31, 2011, after suffering massive losses on European sovereign debt. This event highlighted the risks associated with investing in complex financial instruments and the potential impact of global market turmoil on even well-established firms.

Another case was the collapse of Lehman Brothers, a major investment bank, in September 2008. The bankruptcy of Lehman Brothers was a catalyst for the 2008 financial crisis and served as a stark reminder of the interconnectedness of the global financial system.

Conclusion

The month of August 2011 was a tumultuous period for the US stock market. The combination of the European debt crisis, US economic concerns, and fiscal policy uncertainty led to significant volatility and uncertainty. While the market has since recovered, the events of August 2011 serve as a reminder of the potential risks associated with investing in the stock market and the importance of staying informed about global events.

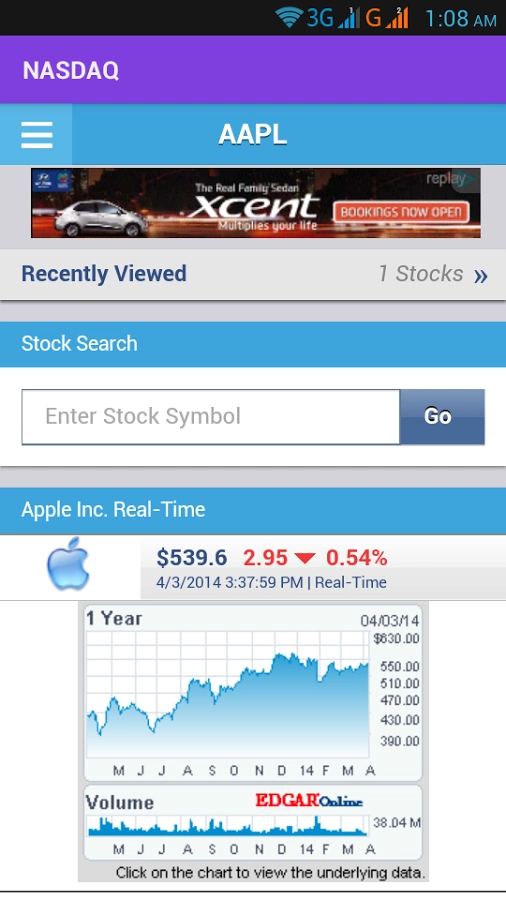

us stock market today live cha